A 72-year-old pensioner waits in line for over an hour. Then, he feels weak, yet the branch has no separate counter for him. In metro cities, a woman in a wheelchair reaches an ATM. She sees stairs but no ramp. She leaves without cash. Now a days, these struggles are becoming more common for senior citizens.

These are not rare incidents. In fact, they happen every day across our country. And the consequences run deeper than mere inconvenience.

Banking today is not just a service; it is a lifeline. People need it to pay hospital bills, collect pensions, and survive emergencies. Yet, senior citizens and differently abled persons often hit invisible walls.

Moreover, India promotes Digital India and makes bold promises of financial inclusion. But, millions still feel excluded — physically, digitally, socially.

This article includes RTI data from 12 major public sector banks. It examines the compliance of RBI guidelines.

Why Accessibility in Banking Matters for Senior Citizens in 2025

India is aging fast. According to the National Statistical Office (NSO), the population aged 60+ reached 149 million 2022, and projections show growth to over 300 million 2050. (NSO report PDF)

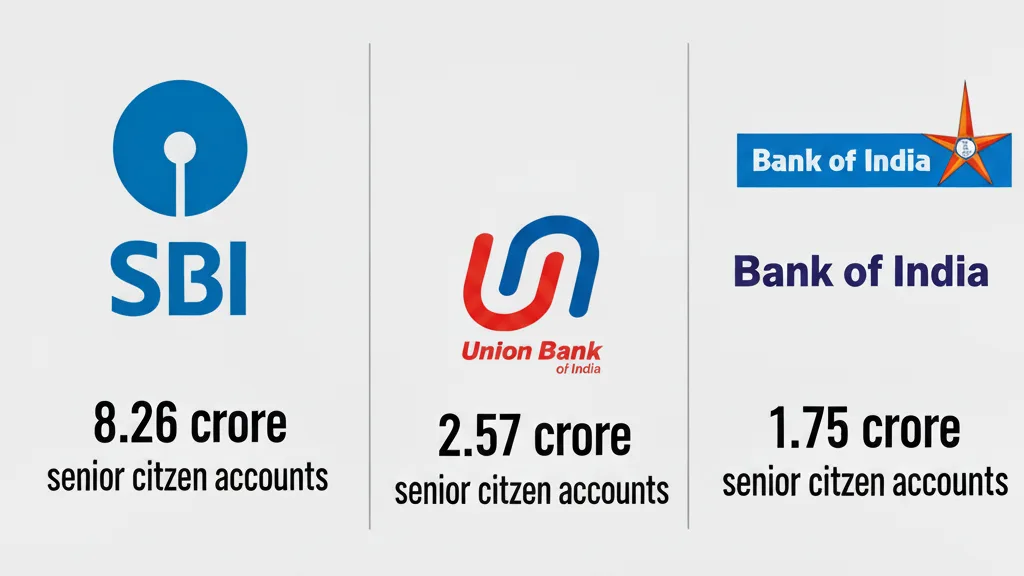

Meanwhile, Census 2011 data reports 2.68 crore differently abled persons in India. That number may be even higher now. These groups aren’t fringe. They hold crores of bank accounts and depend heavily on branch services. For example, the RTI data shows:

When banks fail these citizens, ripple effects emerge:

- Financial independence suffers. For instance, Pensions, savings, and remittances get delayed.

- Healthcare payments stall. For example, Simple tasks like paying for medicines become hard.

- Digital exclusion worsens. For instance, Many “silver users” lack digital literacy.

- Mental health declines. For example, People feel ignored, dependent, invisible.

Look, this isn’t a small issue. It is a national challenge.

RBI Guidelines (Senior Citizens)

The Reserve Bank of India (RBI) knows about these challenges. Over time, RBI issued clear guidelines to protect senior and differently abled banking customers. Yet, implementation falters.

1. Accessible ATMs & Branches

Since 2008, RBI has asked banks to make ATMs accessible for visually impaired users — including talking ATMs and braille keypads. It also instructed that any ATM or branch should have ramps for wheelchair access.

2. Doorstep Banking

In 2017, RBI directed all banks to offer doorstep banking services to senior citizens and differently abled persons. Powered schemes like PSB Alliance, these services should include cash delivery, cheque pick-ups, and document services. Yet, actual spread remains uneven.

3. Dedicated Counters & Priority Service

RBI mandated that banks must provide dedicated or priority counters for senior citizens and differently abled persons. These counters reduce wait times and uphold dignity.

4. Automatic Account Conversion

RBI required that fully KYC-compliant accounts should automatically convert to senior citizens accounts when the customer’s date of birth makes them eligible. Benefits include tax relief and interest rate advantages.

5. Digital Access

With digital banking growing, RBI also emphasized that apps and websites must be accessible (e.g., support for low-vision users, simpler UI).

That said, the RTI responses show gaps. Some banks claimed data under exemptions; others said they do not maintain detailed stats.

Accessibility Is a Right, Not a Favor

Too often, we treat accessibility like a nice extra. Actually, it is a legal requirement.

Under the Rights of Persons with Disabilities Act, 2016, banks are required to ensure accessible infrastructure and service. India also ratified the UN Convention on the Rights of Persons with Disabilities (UNCRPD). These mandate equal access to financial services.

So, when a bank branch lacks a ramp, it is not just bad design. It is a rights violation.

When seniors wait hours without priority service, it reflects systemic neglect.

Even more, these failures erode trust. When you can’t access what others take for granted, you feel invisible. Hence, trust in banking institutions drops, which reduces financial inclusion.

I feel miserable, even in 21st century there are least facilities available to senior citizens and differently abled persons. This blog tries to unveil the harsh reality of all public sector banks in India.

You may have noticed lot of incidents in overcrowded buses where elder persons were denied to have seats. Today, some of transportation corporations added few reserved seats for senior citizens and differently abled persons.

But what in case of long queues at banks?

Are there any policies RBI?

A Wake-Up Call from RTI Data

When we filed Right to Information (RTI) requests with 12 public sector banks, we expected progress. After all, RBI guidelines have been around for more than a decade. Instead, what we found was a mixed bag — some improvements here and there, but a lot of broken promises.

Here’s the twist: while banks like State Bank of India (SBI) and Punjab National Bank (PNB) shared detailed stats, others gave vague replies or cited “data not maintained.” That itself shows how lightly accessibility is treated.

In short, transparency is the first step toward accountability. If banks don’t even count how many accessible ATMs they have, how will they fix gaps?

SBI: The Giant Still Stumbles

SBI is India’s largest bank, with over 22,000 branches and 60,000+ ATMs. You would think it sets the gold standard. The RTI reply, however, paints another picture.

- Senior citizen accounts: 8.26 crore.

- Accessible ATMs: Only about 30% are talking ATMs.

- Ramps at branches: Fewer than 70% branches confirmed.

Think about it. Crores of seniors depend on SBI, but many still face stairs instead of ramps and silent ATMs. A visually impaired user from Delhi even told the TOI that he needed help every time he used an ATM, despite RBI’s 2008 order.

The bottom line, SBI has scale, but not enough inclusion.

PNB: Some Progress, But Far to Go

Punjab National Bank is the second largest PSB. Its RTI reply highlighted:

- Senior citizens accounts: Around 5 crore.

- Talking ATMs: Roughly 12,000.

- Doorstep banking: Services offered, but adoption rates remain unclear.

Especially, it has tied up with the PSB Alliance Doorstep Banking platform, which covers 100+ cities. Yet, ground reality differs. Many users say call centers don’t respond or service charges discourage requests.

However, PNB is trying, but unless frontline staff treat accessibility as essential, policy won’t matter.

Union Bank of India: A Surprising Performer

Union Bank, with 2.57 crore senior citizens accounts, showed better compliance in a few areas. Its RTI reply listed:

- More than 75% of branches have ramps.

- Talking ATMs are increasing each quarter.

- Priority counters exist in most metro branches.

So, the numbers sound good.

Bank of Baroda: Digital Push, Physical Gaps

Bank of Baroda markets itself as tech-friendly. However, Its RTI reply raised red flags.

- Only half of ATMs are accessible.

- Several rural branches lack ramps.

- Doorstep banking is “available” but barely advertised.

Whereas, BOB has strong digital banking tools. But here’s the catch: digital doesn’t replace physical.

Bank of India: Numbers Without Clarity

Bank of India has 1.75 crore senior citizens accounts. But, its RTI reply listed figures but avoided detail. For example, it mentioned “ATMs with accessibility features” without breaking down how many had audio, braille, or ramps.

Central Bank of India & Indian Bank: Patchy Efforts

Both these banks gave partial replies. They admitted gaps in maintaining accessibility data. That silence speaks volumes.

In fact, the 2016 Parliamentary Standing Committee on Social Justice criticized PSBs for failing to track compliance with disability laws. So, when banks still say “data not maintained”, it feels like history repeating itself.

Why These Numbers Matter

Let’s pause here. Numbers alone don’t move hearts. But, when you see crores of accounts attached to those numbers, the human impact becomes real.

Think of this:

- Even if 10% of senior citizens face barriers, that’s over 80 lakh people struggling.

- If half of ATMs lack talking features, millions of visually impaired users depend on strangers for cash.

- When “doorstep banking” is a checkbox service, seniors trek kilometers to reach branches.

Therefore, accessibility gaps don’t show up in balance sheets. But they show up in people’s lives every single day.

The Policy vs Ground Gap

The RBI’s 2017 circular laid out a clear roadmap: priority counters, talking ATMs, magnifiers, ramps, and doorstep banking. On paper, the framework appeared progressive. However, implementation has been uneven, inconsistent, and often symbolic.

Moreover, some banks highlight “100% coverage,” but the ground reality tells another story. For instance, a wheelchair ramp may be too steep, a talking ATM may lack working headphones, and a “dedicated counter” may be used as a general desk. Therefore, the gap between policy and practice remains wide.

Dedicated Counters for Senior Citizens

RBI directed banks to create priority counters for senior citizens and differently abled persons. In theory, this appeared straightforward.

However, our RTI findings show that only 3 out of 12 PSBs maintain actual data on these counters. The remaining banks either gave vague responses or admitted that data was “not maintained.” This directly affects the rights of elderly customers to fair treatment. Additionally, to understand the broader scope of consumer protections available in India, see our guide on Consumer Rights.

For example, a retired teacher dies in UP after standing in bank queue for 8 hours.

As a result, counters exist more in circulars than in practice.

Talking ATMs

Talking ATMs are essential for visually impaired customers. According to bank responses, more than 80% of PSB ATMs now include audio support and braille keypads.

However, maintenance remains a serious issue. In many cases, headphone jacks are broken, audio prompts are outdated, and local language options are missing.

In fact, India’s first Talking ATM, launched in 2012 Union Bank of India in partnership with NCR Corporation, promised a revolution. However, a decade later, the functionality often falls short of expectations. Therefore, accessibility depends not only on installation but also on consistent upkeep.

Magnifying Glasses

Magnifying glasses or sheets were recommended to assist customers with low vision. Out of 12 PSBs, only 4 banks confirmed providing them.

However, even where available, many are broken, misplaced, or locked away. Therefore, this low-cost facility, which could make a meaningful difference, remains underutilized.

Ramp Facilities: Accessibility Denied

Ramps at branches and ATMs are essential for wheelchair access. Nevertheless, RTI responses reveal that only 7 out of 12 banks consistently report ramp coverage. Some even admitted: “Data not maintained.” So, when banks fail to provide ramps or deny wheelchair access, you can raise a formal Consumer Complaint.

Furthermore, a HT report highlighted the denial of accessibility in Goa ATMs. Therefore, while new projects banks show progress, overall compliance remains weak.

Doorstep Banking for Senior Citizens

In contrast to other facilities, Doorstep Banking shows better progress. According to our RTI data, 11 out of 12 PSBs confirmed offering this service. Customers can request cash delivery, cheque pickup, or form submission without visiting the branch.

However, awareness levels are very low. Therefore, effective communication and outreach are as important as policy implementation.

Doorstep Banking Request Template

Failures: When Policy Meets Apathy

Unfortunately, failures often overshadow progress. However, even after few tragedies, policies continue to suffer from poor enforcement. Hence, stronger accountability mechanisms are urgently needed.

The Human Impact

A survey HelpAge India in 2021 found that 65% of senior citizens faced difficulties. Many cited poor staff response and lack of clear facilities. This shows that the problem is not only physical but also emotional. Hence, the impact is both financial and psychological.

Thus, the emotional toll reflects how consumer rights go beyond financial transactions. This is one of the themes highlighted every year on World Consumer Rights Day.

Families Step In

In many cases, family members accompany elders to banks. This reduces independence. A 70-year-old pensioner in Delhi said: “I always ask my son to come with me. Alone, I feel lost.”

Moreover, differently abled customers often depend on strangers for help. This exposes them to risks like fraud. Therefore, lack of accessibility creates layers of vulnerability.

Global Comparison

India is not alone in facing these issues. However, some countries offer useful lessons.

- United States: The Americans with Disabilities Act (ADA) mandates ramps, wide doors, and accessible ATMs. Banks face penalties if they fail to comply.

- United Kingdom: The Equality Act requires banks to provide reasonable adjustments, such as large-print statements and accessible branches.

- Australia: All ATMs must include audio guidance and tactile keypads.

Moreover, customer groups in these countries actively monitor compliance. Complaints often lead to quick action.

Role of Technology

Technology offers hope. Mobile apps can allow pensioners to request doorstep banking. Video banking can help those who cannot travel. Biometric authentication can reduce paperwork.

In addition, fintech startups can partner with PSBs. For example, digital wallets can simplify pension disbursals. Moreover, voice-enabled apps in regional languages can reduce barriers for the visually impaired.

RTI Data Compilation

Therefore, Understanding these gaps helps senior citizens demand better services. To know more about your legal safeguards, explore our article on Consumer Rights.

The Way Forward

India has progressive RBI guidelines. However, guidelines need strict monitoring.

First, banks should maintain accurate data. At present, many PSBs responded with “information not available.” This must change. Without data, there is no accountability.

Second, RBI must set deadlines for compliance. Policies from 2017 cannot wait for another decade. Moreover, penalties should apply to banks that ignore accessibility rules.

Third, staff training is crucial. A ramp or talking ATM is useless if staff do not guide customers. Friendly and patient staff can bridge gaps that machines cannot.

FAQs

- What is bank accessibility for senior citizens?

Banks must provide ramps, priority counters, and talking ATMs. These features make banking safer and fairer. - How do I request doorstep banking from my bank?

Call your branch or use official bank app. Then submit a short written request. - Do banks automatically convert accounts to senior accounts?

Yes, if your DOB is on file and KYC is complete most banks convert automatically. Check with your branch. - What documents should I attach in a consumer complaint?

Attach invoices, chat transcripts, call logs, and photos. Also add your legal notice (if sent). - How do I file a complaint with the RBI Ombudsman?

File online at the Banking Ombudsman portal after 30 days of unsuccessful bank grievance. - Can I file an RTI to ask about bank accessibility?

Yes. Request data on ramps, talking ATMs, DSB branches, and magnifiers. - What if my local ATM has no ramp?

Report it to the branch and file an RTI if ignored. Next, notify RBI and local consumer groups. - Is doorstep banking free for seniors?

Many banks offer it free or at nominal charge. Check the bank policy. - Can someone file on my behalf?

Yes. However, the actual consumer should appear at least once if required. - Are there penalties for banks that ignore rules?

RBI can act, but often it requires public pressure and formal complaints to trigger action.